Registering a company in India is an easy and quick process that helps entrepreneurs start their business efficiently. A private limited company (Pvt Ltd) is a popular choice because it provides limited liability protection to its owners, meaning if the business of a private limited company faces financial or legal problems, the shareholders (members) are only responsible for the money they invested in the company Pvt Ltd company formation requires registering the company with at least two shareholders and two directors, making it a separate legal entity.

The business incorporation of a private limited company requires registration with the Ministry of Corporate Affairs (MCA), selecting a unique business name, and fulfilling all legal requirements. The Pvt Ltd company is a popular choice for many entrepreneurs. Shine Legal India offers assistance with the process of registering a Private Limited Company in India, helping ensure compliance with applicable legal requirements. Our team provides guidance and support at each step of the registration process.

A private limited company, in other words, a Pvt Ltd company, is a corporate legal entity that is privately owned by a small group of individuals for small business. The liability of the members of a private limited company limits the liability of its shareholders (member) to the amount they have invested in the company. All private companies must include ‘Pvt Ltd’ or 'private limited’ in their company name. Section 2, clause 68 of the Companies Act, 2013, provides the definition of a private limited company. A company is a private limited company when it fulfils the following requirements:

Private company compliance requires maintaining records, holding meetings, and filing financial statements to ensure the private limited company operates legally. As a limited liability business, a private limited company is ideal for entrepreneurs who want to minimise personal risk while benefiting from a flexible structure that allows for growth, investment, and protection of personal assets. Shine Legal India provides support to help you manage these processes efficiently.

1. One Person Company - A one person company (OPC) is a special type of private limited company formation that allows a single individual to form and operate a company with limited liability. In an OPC, there is only one shareholder, but it still requires a director to manage the company. This structure is popular among startup legal structures, especially for entrepreneurs who are looking for corporate legal entity status while maintaining limited personal liability.

2. Company limited by shares - A company limited by shares is a private limited company that limits the liability of its shareholders (member) to the unpaid amount on the shares they hold. For example, imagine Rahul is a shareholder who holds 100 shares in a company, each share worth ₹10, and Rahul has already paid ₹5 per share. The liability of Rahul will be limited to the remaining ₹5 per share, meaning if the company is wound up, he owes ₹500 in total.

3. Company limited by guarantee - A company limited by guarantee is a private limited company where the member’s liability is restricted to the amount they have agreed to contribute in case the company is wound up. This amount is specified in the company’s Memorandum of Association (MOA). For example, imagine if the company has 10 members and each member agrees to contribute ₹1,000 in case of the wounding of a company; the total liability would be ₹10,000. However, if the company has assets that can cover the debts, the members don’t need to pay.

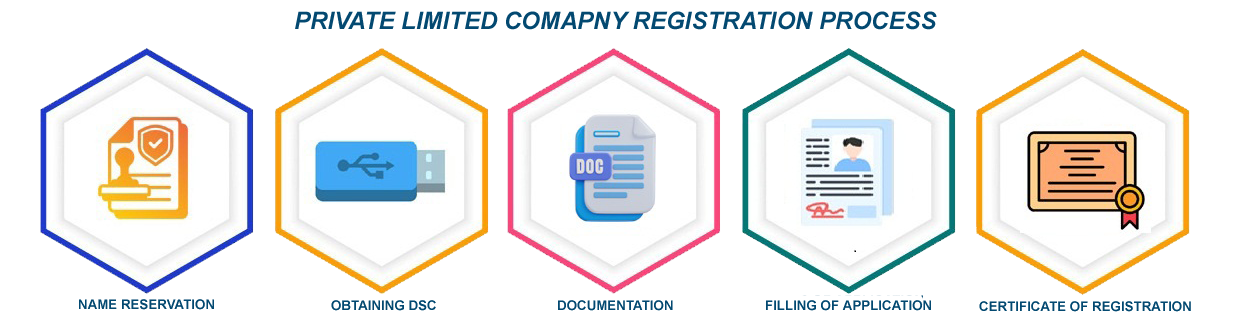

Shine Legal India helps you register your private limited company in India providing step-by-step support throughout the process. The first step in registering your Pvt Ltd company is choosing a unique name. Shine Legal India’s experts will help you pick a unique name that follows Ministry of Corporate Affairs (MCA) guidelines in India. Our team provides personalized advice to match your specific business goals, ensuring an easy online company registration process with clear and upfront fees. Our team helps you with preparing documents, making sure everything is legally compliant at each stage. We provide transparent pricing and keep you updated on your registration progress. Shine Legal India supports you through the company registration process by assisting with legal requirements, allowing you to focus on your business activities.

Pvt Ltd company formation is a process of creating a private limited company. It includes choosing a business name, registering with the Ministry of Corporate Affairs (MCA), and fulfilling legal requirements to set up a company that limits the liability of its owners.

Minimum 2; maximum 200

A Private limited company (Pvt Ltd) has a good legal structure because it limits the liability of the owners which makes it ideal for startups.

A private company is taxed as a separate legal entity. It pays taxes on its profits, and the shareholders may be taxed on dividends they receive from the company.

A company doesn't need a specific amount of cash to start. However, the company must have at least ₹1 lakh as its authorized share capital.

A director and shareholder agreement describes the roles, rights, and responsibilities of directors and shareholders in a company. It helps avoid conflicts by clearly stating the duties of everyone involved in a Pvt Ltd company.

A private limited company provides limited liability protection, tax benefits, credibility with clients, and the ability to raise funds from investors.

To register a private company in India firstly, choose a unique name, secondly, submit necessary documents like the company's Memorandum and Article of Association, and lastly, apply for registration through the Ministry of Corporate Affairs (MCA) portal.

The steps to register a company generally include choosing a company name, submitting your application to the Ministry of Corporate Affairs (MCA), providing legal documents (like the Memorandum of Association), and getting approval from the registrar.